By Bilal Mufti

In these difficult times, small businesses are doing whatever it takes to change and survive. As a small business owner, it’s also important to start reimagining your business for a post-pandemic world. First, assess the financial impact of the ongoing crisis on your business. Second, determine how to reorganize and reposition your business. Third, think about the ways you can transform your business to adapt to the new normal.

- Assess the Financial Impact

If you haven’t created financial statements for your business, now is the time to do so. If you have these statements, it’s time to review and update them. Creating and updating your financial statements will help you to effectively assess the health of your business and focus on the most impacted areas, as described below.

The most important financial statement for your small business is the cash flow statement.

- The cash flow statement lists the amount of cash entering and leaving your business, which shows how well your business manages its money. Common areas of financial impact include decreased revenue due to lower sales, higher costs due to heightened safety measures, and higher debt due to short-term borrowing and deferring of long-term loans.

Two other financial statements to consider are the balance sheet and income statement.

- The balance sheet provides a snapshot of what you own and owe, as well as the amount of equity in your business.

- The income statement shows how much the business earned and spent, typically over the last year.

For assistance on creating these statements, companies such as QuickBooks and FreshBooks have guidelines and templates that will get you started.

Once you’ve assessed the impact on your business, you need to create a financial plan. As a business owner, you might think three to five years in advance, but in these uncertain times, you need to create a contingency plan for the next six to 12 months by managing cash. This means having enough cash on hand to pay off expenses, service short-term debts, and invest in new market opportunities. For help creating a financial plan, Business Development Bank of Canada (BDC) has provided a simple, 6-step guide.

Most importantly, creating and reviewing your financial statements will help you make better decisions and grow your business.2

2. Reorganize and Reposition

Your business may not be the same after the pandemic. If you have employees, they may not operate as before, and your customers may not behave in the way they did previously. To transform the business, it’s important to evaluate your current business model and the operating environment. Considering the biggest impact is on employees and customers, these are the strategic changes your business needs to make:

- Reorganize business operations to allow employees to work flexible hours and the opportunity to work from home. Additionally, create a safe and secure environment for employees that are required to work from the place of business. Provide the necessary technology so they can continue to collaborate and remain productive.

- Reposition the business to serve customers in the most convenient and efficient way. Customers will appreciate the convenience of using online services and increased safety measures at your physical location. Providing these experiences to your customers will make your business even more valuable.

3. Execute Your Business Transformation

Post-pandemic, many businesses are exploring new ways of working and some are already implementing a flexible work environment, including a work-from-home policy. If your business can adopt this policy, it will attract and retain great talent and create a stronger work culture. Workplaces and services will also be required to become much safer, by providing employees with personal protective equipment to minimize the risk of infection.

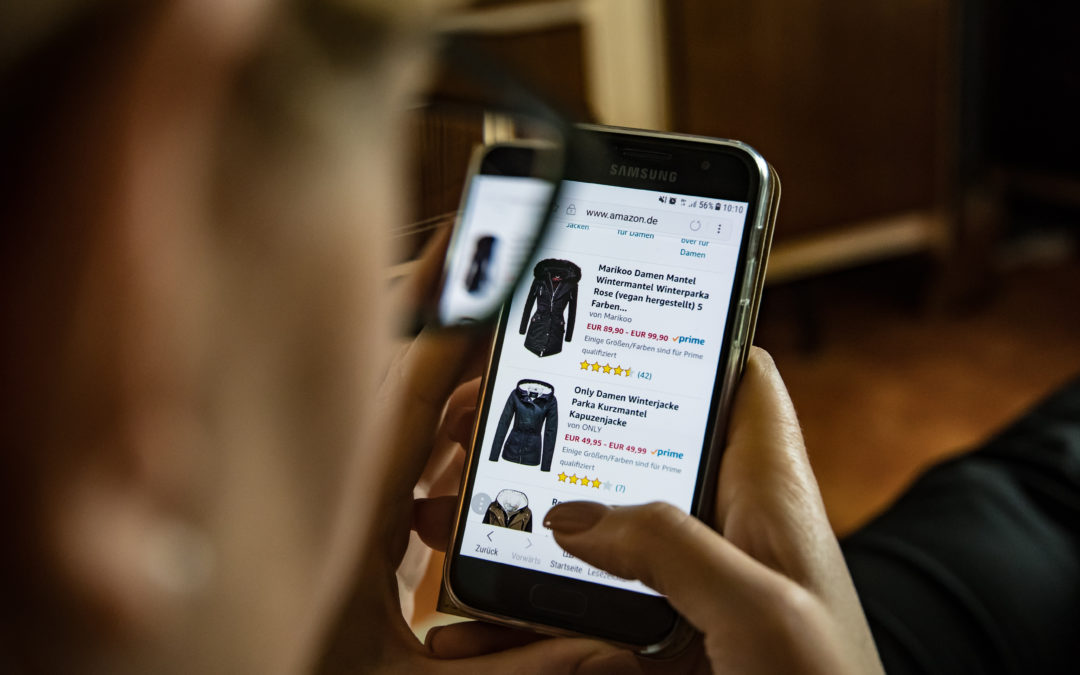

In these times, customers are reluctant to visit physical locations such as offices and stores. This change in customer behaviour will likely continue in the future. This will require businesses to enhance their online presence. Examples include online purchasing for retail, online reservations for restaurants, and home delivery for many other businesses. Although e-commerce is growing rapidly, there will still be a need for face-to-face interactions and in-store experiences. Brick-and-mortar businesses will have to ensure that customers feel safe visiting their locations. Clearly defined safety practices need to be established and communicated to both employees and customers.

Transforming your business will require significant upfront costs but this investment will pay off in the long run, especially in terms of employee trust and customer loyalty. One way to offset these costs and reduce the burden on yourself is to apply for small business loans and government funding.

You must assess the financial impact of the pandemic, reorganize and reposition your business, and execute your business transformation. Taking this three-step approach will help your business thrive in the new normal.

Recent Comments